Some Known Incorrect Statements About Pkf Advisory Llc

Everything about Pkf Advisory Llc

Table of ContentsA Biased View of Pkf Advisory LlcHow Pkf Advisory Llc can Save You Time, Stress, and Money.Pkf Advisory Llc - An OverviewPkf Advisory Llc - An OverviewTop Guidelines Of Pkf Advisory Llc

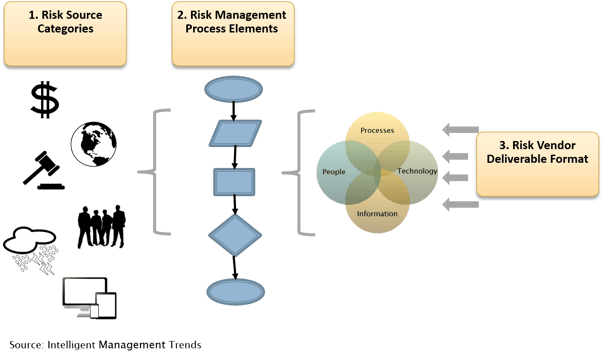

Centri Consulting Risk is an unavoidable component of doing organization, yet it can be handled via extensive assessment and management. As a matter of fact, the bulk of inner and exterior hazards firms deal with can be dealt with and alleviated with threat advisory best practices. However it can be tough to determine your risk exposure and make use of that details to place on your own for success.This blog is made to assist you make the right option by answering the concern "why is risk advising important for organizations?" We'll likewise review internal controls and explore their interconnected partnership with company risk management. Put simply, organization dangers are avoidable internal (strategic) or external risks that influence whether you achieve your organizational objectives.

Every organization needs to have a solid risk administration strategy that details present risk degrees and how to reduce worst-case scenarios. One of the most crucial threat advising finest practices is striking a balance between safeguarding your company while also promoting constant growth. This calls for applying international approaches and administration, like Committee of Sponsoring Organizations of the Treadway Commission (COSO) interior controls and business danger management.

The 7-Second Trick For Pkf Advisory Llc

One of the most effective ways to take care of danger in company is through quantitative evaluation, which utilizes simulations or data to appoint dangers details numerical worths. These assumed worths are fed right into a threat model, which creates a series of results. The outcomes are assessed by danger supervisors, that make use of the information to recognize business chances and reduce adverse outcomes.

These reports also consist of an analysis of the effect of adverse outcomes and reduction strategies try this website if negative occasions do happen. Qualitative risk tools consist of domino effect layouts, SWOT analyses, and choice matrices. Created by the Institute of Internal Auditors (IAA), the 3 lines of protection (3LOD) model offers a framework for identifying, fighting, and mitigating organization risks and dangers.

With the 3LOD version, your board of directors is responsible for danger oversight, while elderly management develops a business-wide risk society. Responsible for owning and reducing threats, functional managers look after day-to-day service ventures.

Pkf Advisory Llc Can Be Fun For Everyone

These jobs are generally taken care of by financial controllership, quality control groups, and conformity, that may likewise have duties within the initial line of protection. Interior auditors supply unbiased guarantee to the first two lines of protection to ensure that dangers are handled appropriately while still fulfilling functional goals. Third-line employees must have a direct connection with the board of supervisors, while still keeping a connection with administration in financial and/or legal abilities.

An extensive collection of inner controls must include items like reconciliation, documents, security, permission, and splitting up of obligations. As the number of ethics-focused financiers continues to raise, several services are adding environmental, social, and governance (ESG) standards to their internal controls. Capitalists make use of these to establish whether a firm's worths align with their very own.

Social standards examine how a firm handles its relationships with employees, consumers, and the bigger community. They additionally increase efficiency and enhance conformity while enhancing operations and helping stop fraud.

The Best Strategy To Use For Pkf Advisory Llc

Building an extensive set of inner controls includes approach positioning, systematizing plans and treatments, procedure documentation, and developing functions and obligations. Your interior controls need to integrate danger advisory finest methods while always remaining concentrated on your core business purposes. One of the most efficient inner controls are purposefully segregated to avoid possible conflicts and lower the danger of economic fraud.

Developing good interior controls entails carrying out policies that are both preventative and investigator. They consist of: Restricting physical accessibility to equipment, supply, and money Separation of responsibilities Permission of invoices Confirmation of expenses These backup procedures are designed to detect adverse end results and threats missed by the first line of protection.

Internal audits include an extensive analysis of a company's internal controls, including its bookkeeping practices and corporate management. They're designed to ensure regulatory compliance, along with precise and timely economic coverage.

A Biased View of Pkf Advisory Llc

According to this regulations, monitoring teams are lawfully responsible for the accuracy of their business's economic declarations - environmental, social and governance (esg) advisory services. In addition to securing investors, SOX (and inner audit support) have actually dramatically boosted the integrity of public accountancy disclosures. These audits are performed by neutral 3rd parties and are made to examine a business's audit treatments and inner controls